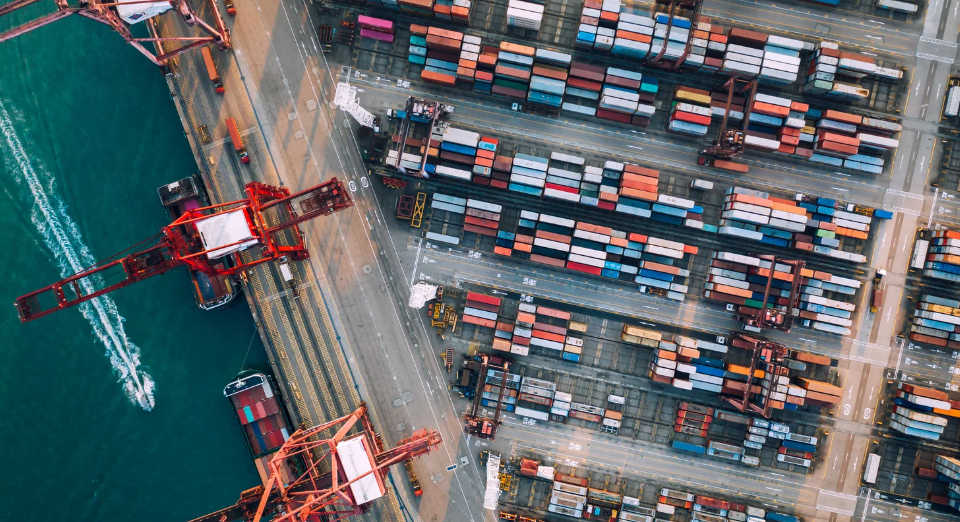

Trump Announces Increase in Tariffs

September 13, 2019

Trump Announces Phase One Of Trade Deal With China

October 11, 20193 New Rounds of Exclusions to China Section 301 Duties

Customs has issued three notices regarding additional exclusions for China tariffs as listed on the below and attached links. All of these are in effect through 09/20/2020. Please note the descriptions on the various exclusions are only given on specific products and not everything within the tariff number. Please be sure the actual product applies before requesting exclusions.

Tranche list 1 – Federal Register notice 84 FR 49564 advises the Tenth round of products excluded from list 1 is available on the link. In addition to reporting the regular Chapters 84, 85, 87, 88 and 90 classifications of the HTSUS for the imported merchandise, importers shall report the HTSUS classification 9903.88.14 (this list was previously provided, but has been revised). Effective 07/06/2018 until 09/20/2020.

Tranche list 2 – Federal Register notice 84 FR 49600 advises the Eleventh round of Products excluded from list 2 is available on the link. In addition to reporting the regular Chapters 39, 73, 76, 84, 85, 86, 87 and 90 classifications of the HTSUS for the imported merchandise, importers shall report the HTSUS classification 9903.88.17. Effective 09/24/2018 until 09/20/2020.

Tranche list 3 – Federal Register (FR) Notice 84 FR 49591 advises the Ninth round of products excluded from list 3 is available on the link. In addition to reporting the regular Chapters 38, 39, 40, 42, 44, 46, 48, 54, 55, 59, 73, 76, 83, 84, 85, 87, and 94 classifications of the HTSUS for the imported merchandise, importers shall report the HTSUS classification 9903.88.18. This is effective from 09/24/2018 until 08/07/2020.

CSMS #39981444 of September 26, 2019 also clarifies CBP’s instructions on entering sets and components. If the component(s) in the set is not subject to Section 301 duties, then the HTS# associated with the set will have the applicable duty rate applied as per the procedures outlined with the respective Tranche (list). If, however, the set and the component(s) are subject to Section 301 duties, then importers and brokers are required to follow the guidance provided in CSMS #39981444 on transmitting the correct HTS code and duty rate according to the applicable Tranche for the component(s).

It is still anticipated that the Section 301 duties will increase from 25% to 30% on October 15, 2019 for Lists 1 through 3. List 4B is anticipated to go into effect on December 15, 2019 at the current rate for List 4A of 15%.

Additional information may be obtained by contacting your Western Overseas representative.