Port Congestion Update 09/10/21

September 13, 2021

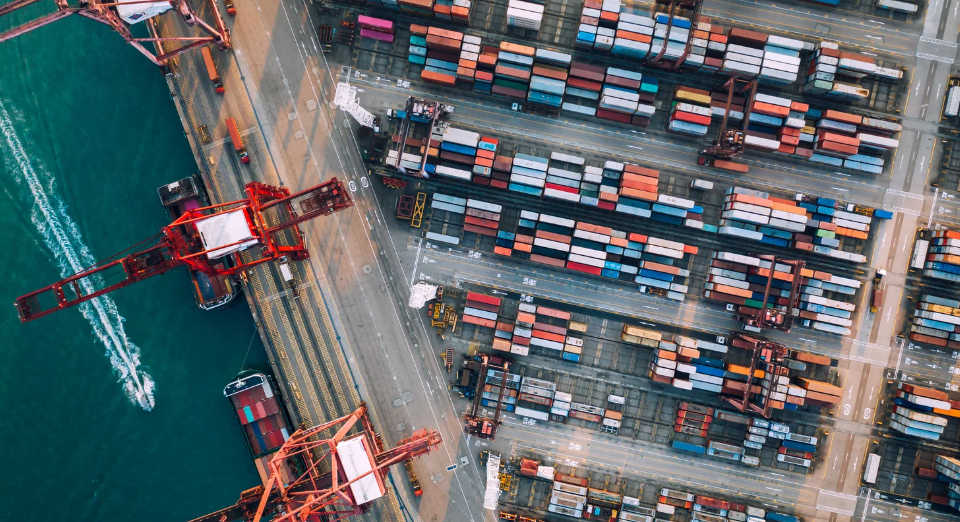

San Pedro Bay Ports Announce New Measures to Speed Cargo Throughput

September 21, 2021Weekly Vessels Anchored and at Terminals as of 09/17/2021

Vessel Congestion Update

Container Ship Numbers at Record High

Container volumes continue to set records at both ports. The Port of Long Beach (LB) reported their August traffic was 11.3% higher than 2020 as dockworkers and terminals handled over 800k TEUs. Data for the month of August at the Port of Los Angeles is not available, however, it is estimated to also be at record numbers. The Port of Long Beach reported consumer demand softened slightly in August from the previous month with overall retail sales at about 18% above pre-pandemic levels. The port continues to exceed monthly cargo records for 13 of the last 14 months. Mario Cordero, Executive Director of the Port of LB stated in part, “It’s peak season now, but we are likely to see continued cargo growth well into 2022.”

According to the Southern California Marine Exchange, the number of container vessels within the San Pedro Port Complex, either at a terminal or at anchorage, broke records this week with a high of 88. Of this number, a new high of 56 container vessels are at anchor or drifting and the anchor and drift locations are full. The drift area reached a record of 20 vessels, which consisted of 16 container ships and 4 tankers. As container vessels are shifted to a terminal, additional container vessels are scheduled to arrive at anchorage or in the drift area. Simply put, the port complex is full.

Vessel anchorage wait times on average are 11-15 days with an average of 35-40 vessels at anchorage or drifting. The ports normally do not report the number of days vessels are anchored or at drift outside of the port anchorage areas along the coastline. Inside the port, these areas are being reported with wait times of 7.9-8.8 days. The amount of time a container is sitting onshore at the terminal before being loaded onto trucks has increased. The wait time before containers are loaded onto outbound trains is estimated at two weeks.

Terminals at Capacity

The ILWU contends they are working with three to four work gangs and report that it takes up to eight gangs to work the larger container vessels. They also lack certified skilled labor which includes crane operators, top loader drivers, heavy forklift drivers as well as other classifications. The terminals need to move out empty containers to allow room to unload the arriving inbound containers which is paramount to relieve on-dock congestion.

Warehouse Space

Trucking companies are dispatching trucks to pick up containers for delivery to inland facilities only to find they cannot deliver the containers to the warehouses because they are full. This means the trucker has to hold containers for one or two weeks in their yard as the warehouses claim not to have the workforce to unload the containers.

Transpacific Advisory

The transpacific continues to face challenges and impact the entire global supply chain as COVID-19 outbreaks remain a concern across Asia. The Vietnamese official’s recent lockdown as well as factory closures in Malaysia and Indonesia have become a common occurrence. Not much is expected to change in terms of available carrier space as they continue to operate in a high-volume capacity environment for the rest of 2021.

Equipment Shortages

The severity of empty container shortages continues to rise across Asia. It remains critically important that import containers are turned around as quickly as possible. Empty returns to the carriers are needed as vessels are departing the west coast without enough empties. Carriers and port officials continue to urge truckers to utilize weekend gates and any available alternatives to return equipment to keep cargo containers moving. According to carriers, the in-fleeting of the new containers alone is not sufficient to meet the overall demand.

Inflation

Currently, the U.S. and global supply chain crisis does not have a quick fix and inflation is surging. Time Magazine reported the cost of goods in July was up by 5.4% compared to July from the same period last year. This is the largest annual increase since 2008, and economists agree that the overwhelmed logistics network is mostly to blame as the cost of shipments, in many cases, has quadrupled. An important question remains, will buyers pay the higher prices?

Please contact your Western Overseas representative with any questions.