Port Congestion Update 10/29/21

November 1, 2021

Port Congestion Update 11/12/21

November 15, 2021Weekly Vessels Anchored and at Terminals as of 11/05/2021

LA & LB: Anchored 70 | Terminal 26

Oakland: Anchored 7 | Terminal 3 | Drifting (nil)

NWSA: Anchored 4 | Terminal 4 | Drifting 5

Vessel Congestion Update

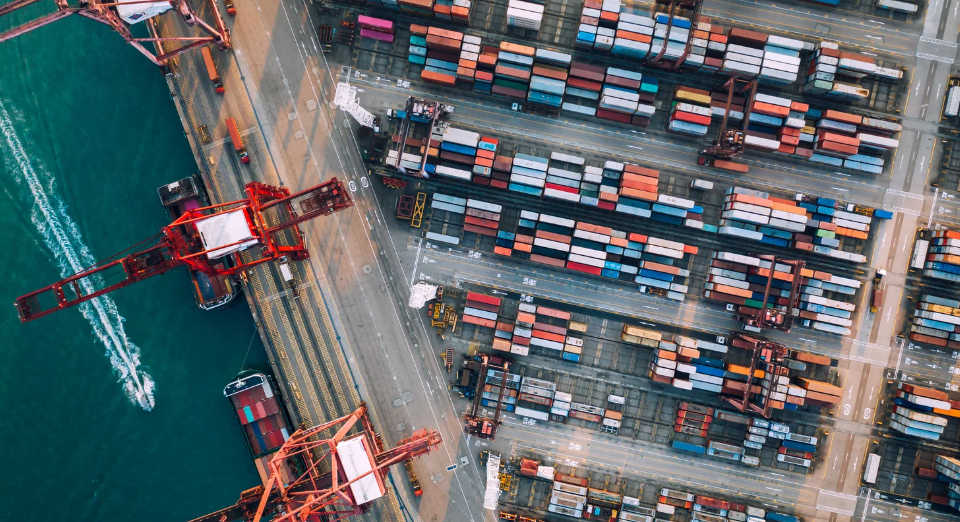

On November 3, 2021, the Southern California Marine Exchange reported a total of 159 ships in the port complex of Los Angeles (LA) and Long Beach (LB). This includes 102 container ships with 76 at anchorage/drift areas and 26 at berth/terminal. The container vessels are waiting for an average of 13-14.1 days to reach a terminal to unload.

Ports of LA/LB – Controversial Container Dwell Fee on Ocean Carriers

A new program started on November 1, 2021, to charge a new fee for not picking up cargo within a certain period of time, however, the fee will not be assessed until November 15th. The ports will assess a fee on ocean carriers for import containers that dwell on marine terminals. This is designed to speed the flow of cargo from the terminals amid unprecedented congestion dating back to summer 2020, and exacerbated by the peak holiday season resulting in overcrowded ports. Gene Seroka, Executive Director Port of LA, stated in part, “Imposing fines for lingering cargo was ‘a last resort’ but it is starting to help.” Shortly after the policy was announced, the ports were “starting to see movement.”

Congestion at docks is delaying the berthing of vessels leading to a record number of vessels waiting off the coast as consumers and businesses across the country are left waiting for cargo shipments. Amid reports that expanded gate hours were not being utilized, the ports announced they will assess the surcharge on ocean carriers for import containers that stay on marine terminals once the grace period ends. The fees will be assessed as follows:

- Nine days or more for containers scheduled to move by truck.

- Six days or more for containers scheduled to move by rail.

- The fee will be $100 per container, increasing to $100 increments per container per day.

Port of Tacoma Terminals to Charge “A Long-Term Dwell Fee”

Husky Terminal & Stevedoring (HTS) and Washington Terminal (WUT) in the Port of Tacoma have announced, “Effective on November 15, 2021, local import containers, having exceeded 15 calendar days on their terminal will incur a Long Stay Rehandling Fee (HTS $315 and WUT $310). Containers will be placed on hold and payment to the terminal will be due prior to making a pickup appointment.” This action is designed to encourage and improve the movement time to remove locally offloaded containers from their facilities. Both terminals urge a rapid movement of local imported containers to relieve the lack of on-dock space.

Infrastructure Funding to Improve LA/LB Port Complex

The State of California has the fifth-largest economy in the world and has the attention of the Supply Chain Disruptions Task Force, led by Port Envoy, John Porcari, supported by the Biden-Harris Administration. Last week, Pete Buttigieg, U.S. Secretary of Transportation said in a prepared statement, “Our supply chains are being put to the test, with unprecedented consumer demand and pandemic-driven disruptions combining with the results of decades-long underinvestment in our infrastructure.” Not content to wait for Congress to pass a big infrastructure spending bill, Gavin Newson, Governor of California, and Buttigieg moved on October 28, 2021, to inject $5 billion of low-interest loan funding in partnership to ensure the funding of local infrastructure projects. This is aimed to improve freight movement between the twin ports and distribution centers in the Inland Empire. The money would modernize California’s seaports and while it may not help unclog the current severe congestion that is creating seaport chaos, both indicated that modernizing ports and the truck and rail system that serve the ports can prevent logistic nightmares in the future. The port funding could be used for port-specific upgrades such as expanding rail capacity and developing inland port facilities for increased warehouse storage. Other options include increasing freight rail capacity, truck and rail electrification, highway upgrades, and other areas to improve the flow of the cargo. Completion dates have not been provided and it is anticipated to take several years. Both ports identify rail as the top priority for the funding initiative to enhance the faltering supply chain.

On October 18, 2021, Mario Cordero, Executive Port Director stated in part: “The San Pedro Port Complex anticipates processing 20 million TEU containers this year and it is expected to increase to 25 million TEU in a few years. Earlier this year, the Port of LB committed funding for infrastructure rail improvement, referring to Pier B, an off-dock rail project. The capital improvement project has been in the planning stages for over 10 years. The $870 million project is not slated for completion until 2032, after portions of track open in 2024 and 2030. The first phase is projected to double the capacity of the existing Pier B rail yard which is planned for the next decade, according to the Port of Long Beach.

Projections: When Will LA/LB Port Congestion Clear?

- Shipping backlogs at LA/LB ports are not likely to resolve themselves until well into 2022, according to economists.

- Goldman Sachs indicates, “The problems should lessen after the holidays and Lunar New Year as container traffic backs off.”

- Mario Cordero, Executive Director Port of Long Beach, stated on October 28, 2021, during an interview with Bloomberg, “Americans should buy their holiday gifts early this year, as the container glut plaguing ports and the supply chain will persist through at least to the year’s end. Containers increased by 24% this year through September 2021 and the unprecedented increase of cargo continues to be attributed in part to surging e-commerce orders.

Please contact your Western Overseas representative with any questions.