Supply Chain Update

August 3, 2022

Fees That May Trickle Down to Shippers and Importers

August 10, 2022Inflation or Recession

U.S. Feds Take Action

Last week, Jerome Powell, U.S (United States) Federal Reserve Chairman, announced another 0.75%-

point interest hike and was quoted in part, “We think we need a period of growth below potential in

order to create some slack.” This latest increase brings the federal funds rate between 2.25% and 2.50%,

which is where it was at its most recent high in mid 2019 prior to the coronavirus pandemic. Powell also

indicated the Federal Reserve anticipates additional rate hikes which would increase slowly and could

lead to further hikes in 2023. Powell does not think that the U.S. is currently in a recession as many

areas of the economy are performing “too well.” Specifically, mentioning the labor market, saying that

job growth is slowing but that is expected, and we are in a strong labor market.” Janet Yelen, Treasury

Secretary, indicated the economy is slowing down but the economy is not in a recession and was quoted

in part, “The economy is in a period of transition.” The Federal Reserve anticipates prices for goods in

the U.S. will continue rising through 2023 and the raising of interest rates should be expected.

Retail Growth Anticipated

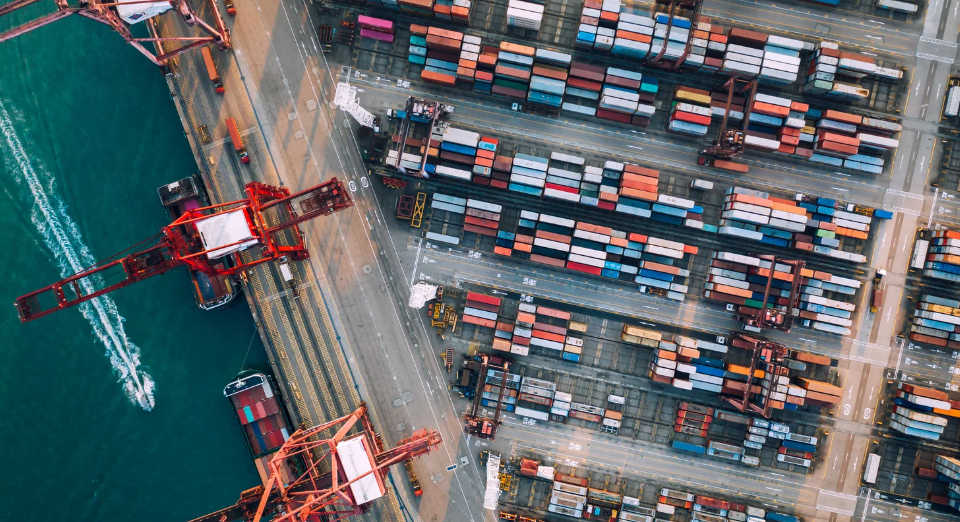

In June 2022, the National Retail Federation (NRF) indicated that more than two years after the start of

the pandemic, we are still witnessing significant challenges in the supply chain. While we are not

experiencing as many container vessels sitting at anchor waiting to dock at West Coast ports compared

to the peak of congestion in 2021, several issues continue to impact the global supply chain. Some

include continued shipment delays from China of both finished goods for retailers and intermediate

goods for U.S. manufactures. Shippers, Importers, and Retailers will need to adjust as necessary to meet

increased consumer demand and expectations. Despite the continuing issues, the NRF believes imports

will continue to grow in 2023, as reflected in a recent Global Port Tracker report.

Call Continues to Remove Chinese Tariffs

The NRF continues to call on Congress to lower inflation now and one solution remains to remove

damaging tariffs on goods from China that have cost U.S. importers over $140 billion since 2018.

Please contact your Western Overseas representative with any questions.