U.S. Rail Cargo Union Negotiation Update

October 17, 2022

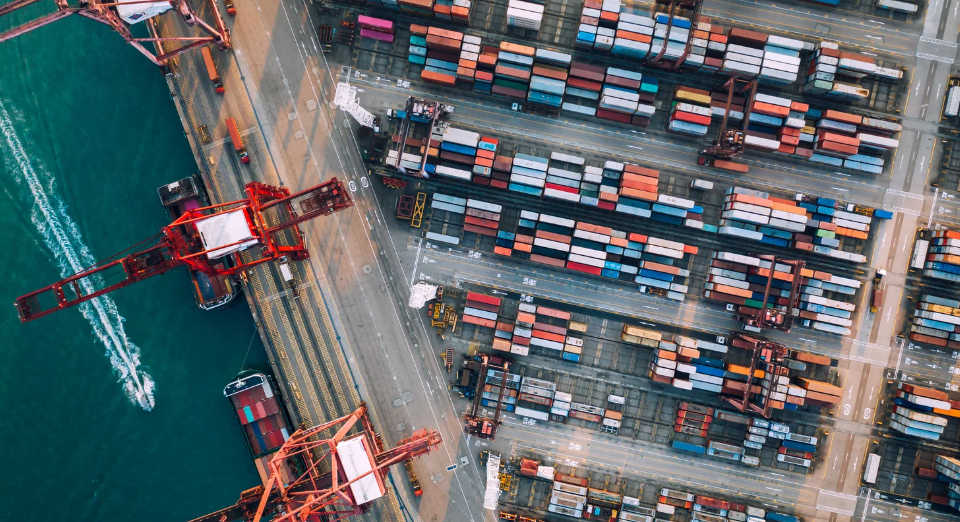

Global Shipping Industry Updates October

October 24, 2022Status of U.S. Economy and Consumer Buying Trend

U.S. economy is ‘doing well’ amid global economic uncertainty,

says Treasury Secretary Janet Yellen

Last week on October 11, 2022, Janet Yellen, U.S. Treasury Secretary, provided the following insight regarding the condition of the overall global economy.

- The U.S. is doing well amid global economic uncertainty

- The U.S. economy was expected to slow down after a strong recovery, but a recent job report revealed a “very resilient” economy

- Inflation in the U.S. is too high and lowering it is a priority of the Biden administration

Yellen said that the U.S. economy is doing “very well” as rising energy prices, Covid-19 variants, and Russia’s war on Ukraine have affected the global markets. A recent jobs report released last week revealed, “a very resilient” economy as the Bureau of Labor Statistics reported on October 10, 2022, that the unemployment rate fell to 3.5%, which tied for the lowest level since late 1969.

Consumers have been constrained by prices rising at close to their fastest pace in more than 40 years. The latest New York Federal Survey of Consumers Expectations indicates that consumers expect the inflation rate a year from now to be 5.4%, the lowest number in a year and a decline from 5.75% in August 2022.

In June 2022, the inflation level peaked at 6.8% and has been coming down since then as the central bank instituted a series of rate hikes totaling 3 percentage points. The Federal Reserve will meet in November and December and most economists predict the feds, at the conclusion of each of their meetings, will increase interest rates which is hoped to continue to reduce inflation.

Yellen’s priority continues to acknowledge that inflation is too high and that lowering it is a priority for the Biden administration while maintaining a healthy labor market. As inflation expectations seem to be easing, consumer spending outlook is tumbling, according to the Federal Consumer Survey.

While U.S. consumers have experienced an increase in inflation, in June 2022, the level peaked at 6.8% and has been coming down because of the Feds continuing action to raise interest rates with the goal of bringing inflation down to a long-run target of 2%.

The near-term outlook for inflation indicates improvement, however, household spending growth of 6% will continue next year. On October 13, 2022, an ABC TV economist indicated, savings account funds continue to decline as household costs range on average of $500 a month for mere necessities. Cost for fuel and gasoline remains high.

Jonathan Gold, National Retail Federation Vice President for Supply Chain and Customs Policy Federal Retail Association, indicated this year cargo failed to experience a “peak season”, however, he anticipates consumers will spend during the Christmas/Holiday season.

For any questions regarding these updates, please contact your Western Overseas representative.