Regulating Imports with a Reciprocal Tariff to Rectify Trade Practices that Contribute to Large and Persistent Annual United States Goods Trade Deficits

April 9, 2025

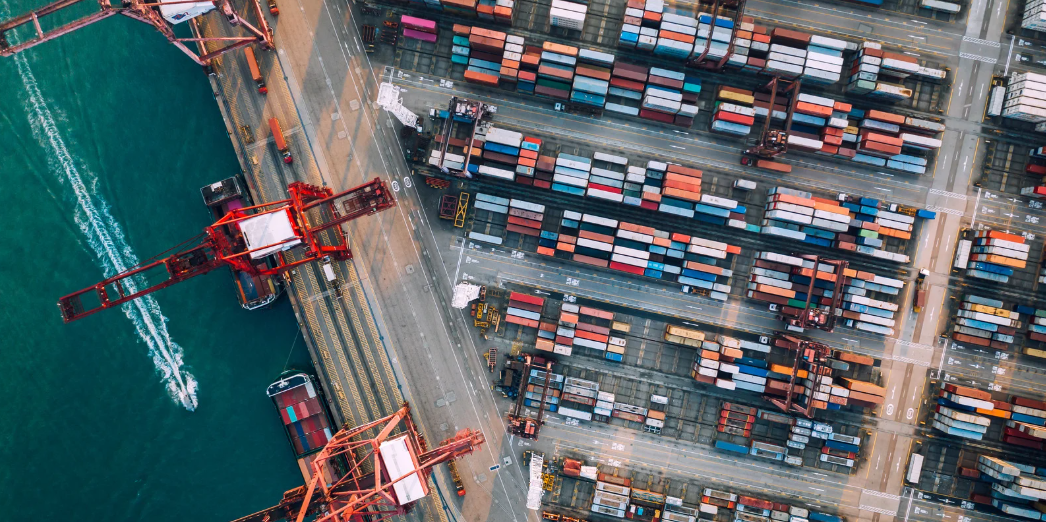

Global Shipping, Local Support: How Western Overseas Corporation Keeps Your Supply Chain Moving

April 11, 2025UPDATE: Clarifying Recent Reciprocal Tariffs

We understand that there has been quite a bit of turmoil and confusion recently with the Trump Administration’s recent tariff announcements. We have composed the following summary of changes that have occurred over the last few weeks to help clarify the current situation:

1. USMCA products that are eligible for USMCA consideration are excluded from the Liberation Day Tariffs (effective April 5th and 9th) and continue to enjoy the exemption so long as they meet USMCA criterion. I.e. Product of Mexico or Canada shipped directly from Mexico or Canada. Mexico or Canada products that are shipped from elsewhere in the world are ineligible for the USMCA consideration and therefore subject to the imposed 25% tariff.

1. As of 12:01 AM EST April 5th, all products arriving from all countries will be subject to 10% additional tariff applied above the usual general duty rates of the US HTS as well as any other tariffs as applicable. Exemptions from these tariffs would be articles previously covered under the 232 tariffs, personal importations and other informational articles imported under the provisions of 50 USC 1702(b) (previously excluded from all other tariffs imposed this year), automobiles and automotive parts covered under a separate order issued March 26th, articles covered by annex II of the order issued yesterday and attached for your review (includes mining raw materials and pharmaceutical products), and any article that is imported from a non beneficial trading partner and subject to column 2 duty rates in the US HTS (I.e. Iran, Syria, North Korea, etc.). These apply above the elevated 301 tariffs against China. China therefore to increase from 27.5% or 45%, depending on the list from the 301 tariffs, to 37.5% and 55% respectively as of April 5th.

1. As of 12:01 AM EST April 9th, for the countries listed in Annex I attached, the rate will be increased from 10% to the rates listed in the table for each respective country. All exemptions listed in point 1& 2 will remain in effect, just the tariff rate increases. Still applicable as additional to any other active tariffs including the already elevated 301 tariffs against China. This also does not consider Anti-dumping and Countervailing duties that apply above all levels as applicable. So China 301 tariff rates can be 61.5% to 79% depending on what list the products were on for the original 301 tariffs.

1. Transit exemptions for the Liberation Day Tariffs provided for both cutoffs stating that articles loaded before 12:01 am EST on April 5th and already in transit to the US prior to that will be exempt from the 10% base tariff. Between 12:01 AM EST April 5th and 12:01 am EST April 9th, articles from countries of Annex I loaded and/or in transit during this period will be subject to the 10% base tariffs, but exempt from the elevated tariffs for their respective country. Articles of countries from Annex I loaded after 12:01 AM EST on April 9th or in transit after this time will be subject to the elevated tariffs.

1. Importers subject to the Liberation Day Tariffs as well as the Auto and USMCA tariffs are being allowed to declare US origin composition in imported products so as to not pay tariffs on the US material, however it has to match the following criteria:

1. -quote- More generally, the ad valorem rates of duty set forth in this order shall apply only to the non-U.S. content of a subject article, provided at least 20 percent of the value of the subject article is U.S. originating. For the purposes of this subsection, “U.S. content” refers to the value of an article attributable to the components produced entirely, or substantially transformed in, the United States. U.S. Customs and Border Protection (CBP), to the extent permitted by law, is authorized to require the collection of such information and documentation regarding an imported article, including with the entry filing, as is necessary to enable CBP to ascertain and verify the value of the U.S. content of the article, as well as to ascertain and verify whether an article is substantially finished in the United States. -end quote-

2. Under this provision, importers would have to provide a breakdown of the materials being imported and be able to substantiate that the material is at least 20% composed of US product in order to get the US product value removed from tariff consideration. Rules of origin would be in effect therefore the determination of permissibility by US customs would be subject to their discretion and determination if the US product loses its identity altogether from the processes performed overseas. If you are able to determine the percentage composition of the US components and break them out on the documentation, then they can be submitted with the US value deducting from the tariff amount.

2. Tariffs of 25% against countries that import Venezuelan Oil, directly or indirectly, may be assessed above current and future tariffs levels following review by the USTR and Secretary of State if these will apply after April 2nd. This tariff is still unclear how it will be applied but should be considered a possibility.

3. Section 232 Tariffs against Steel and Aluminum were modified to remove a limited list of products and derivatives subject to the 232 tariffs and amended to include all products under Chapter 72, 73 and 75 for classification, adjusting to a flat 25% tariff rate. Derivatives still remained a specific list of products whose nominations are in the annexes provided by the executive orders.

4. China 301 tariffs have been increased from 7.5% or 25%, depending on the previous lists from the original 301 tariffs to 27.5% and 45% respectively. All other duties and tariffs are still applicable above the 301 tariffs against China.

Links to the various executive orders can be found at the following hyperlinks:

Liberation Day Tariffs: https://www.whitehouse.gov/presidential-actions/2025/04/regulating-imports-with-a-reciprocal-tariff-to-rectify-trade-practices-that-contribute-to-large-and-persistent-annual-united-states-goods-trade-deficits/

Automobile and automobile parts: https://www.whitehouse.gov/presidential-actions/2025/03/adjusting-imports-of-automobiles-and-autombile-parts-into-the-united-states/

Mexico USMCA Tariffs: https://www.whitehouse.gov/presidential-actions/2025/03/amendment-to-duties-to-address-the-flow-of-illicit-drugs-across-our-southern-border/

Canada USMCA Tariffs: https://www.whitehouse.gov/presidential-actions/2025/03/amendment-to-duties-to-address-the-flow-of-illicit-drugs-across-our-northern-border-0c3c/

Venezuelan Tariffs: https://www.whitehouse.gov/presidential-actions/2025/03/imposing-tariffs-on-countries-importing-venezuelan-oil/

Steel 232 Adjustment: https://www.whitehouse.gov/presidential-actions/2025/02/adjusting-imports-of-steel-into-the-united-states/

Aluminum Adjustment: https://www.whitehouse.gov/presidential-actions/2025/02/adjusting-imports-of-aluminum-into-the-united-states/

Synthetic Opioids: https://www.whitehouse.gov/presidential-actions/2025/02/imposing-duties-to-address-the-synthetic-opioid-supply-chain-in-the-peoples-republic-of-china/

For questions or concerns, please contact your Western Overseas Company representative.